Financial management is an essential aspect of running any successful business. Proper financial management involves tasks such as tracking income and expenses, managing cash flow, creating and monitoring budgets, and analysing financial statements. However, doing all of these tasks manually can be time-consuming and prone to errors.

Fortunately, financial management software can help businesses streamline these tasks and gain a better understanding of their financial health. Here are some ways that financial management software can benefit your business:

Automating tasks: Financial management software can automate many routine tasks such as data entry, invoicing, and bill payments. This can save time and reduce the risk of errors.

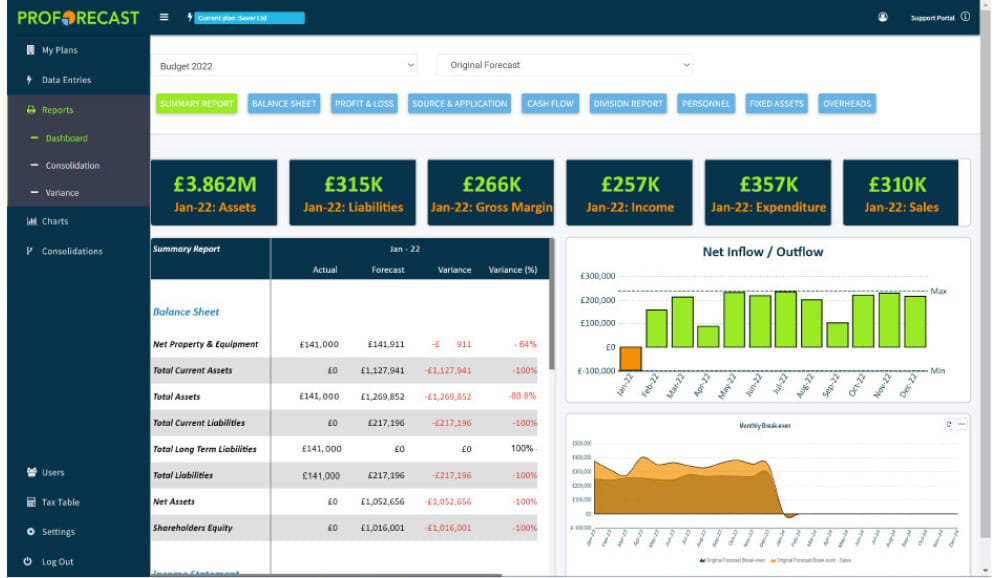

Better financial visibility: With financial management software, businesses can get a better understanding of their financial performance in real-time. They can generate reports on various financial metrics such as revenue, expenses, profit margins, and cash flow. This information can help businesses make informed decisions and adjust their strategies accordingly.

Improved cash flow management: Financial management software can help businesses better manage their cash flow by providing visibility into cash inflows and outflows. This can help businesses avoid cash flow issues such as late payments or insufficient funds.

Better budget management: Financial management software can help businesses create and monitor budgets. By setting up a budget in the software, businesses can track expenses against their budget and identify areas where they may be overspending.

Integration with other systems: Financial management software can integrate with other systems such as accounting software, point-of-sale systems, and payroll systems. This can help businesses streamline their financial processes and reduce manual data entry.

Overall, financial management software can help businesses improve their financial management processes, gain better visibility into their financial health, and make more informed decisions. If you’re looking to streamline your financial management processes, consider investing in a financial management software solution.

Simplifying tax compliance: Financial management software can help businesses simplify tax compliance by providing tools to track and calculate taxes, generate tax reports, and prepare tax returns. This can help businesses avoid errors and penalties related to tax compliance.

Enhancing security: Financial management software can help businesses enhance security by providing secure access to financial data and ensuring that financial transactions are secure and accurate. This can help businesses avoid fraud and data breaches.

Improving collaboration: Financial management software can help businesses improve collaboration by providing access to financial data and reports to multiple users within the organisation. This can help improve communication and decision-making within the organisation.

Enhancing forecasting capabilities: Financial management software can help businesses enhance their forecasting capabilities by providing tools to project future financial performance based on historical data and trends. This can help businesses plan for the future and make informed decisions about investments, expenses, and growth opportunities.

Improving customer relationships: Financial management software can help businesses improve their customer relationships by providing tools to manage customer accounts, track payments, and generate invoices. This can help businesses provide a better customer experience and improve customer satisfaction.

In summary, financial management software can offer numerous benefits to businesses of all sises and industries. Whether you’re looking to streamline your financial processes, gain better visibility into your financial health, or improve collaboration and decision-making within your organisation, investing in a financial management software solution can help you achieve your goals and set your business up for long-term success.